travel nurse taxes allnurses

If you are traveling away from home on business which is what most travel nurses do the IRS allows you to deduct expenses on your tax return. So lets take a look at a few tax tips for nurses and the most common things you can deduct.

The Traveler S I Ve Seen Add Yours General Nursing Support Stories Allnurses

Make sure you have paperwork proving your start and end dates to prove temporary work.

. Im getting state takes for my travel state taken out of my pay. Even in difficult economic times the fully blended rate for the average travel nursing contract is still somewhere between 37hour-43hour. Our mission is to Empower Unite and Advance every nurse student and educator.

The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future. Luckily I was able to take a local contract for crisis pay with a travel nurse agency. Be subject to Ca.

When i file my taxes will i have to file for a MT state tax also along with my home state. Many travel nurses out there may be wondering. Here is a link to a great websites FAQ page about travel taxes.

Our members represent more than 60 professional nursing specialties. I could take a travel assignment in my same hometown and still receive benefits but where a lot of travel nurses will end up keeping money is on stipends and stipends not being taxed. 2020 TAX GUIDE FOR TRAVEL NURSES 2 2020 is a year like weve never seen before.

Since 1997 allnurses is trusted by nurses around the globe. Dont work in one location for more than 12 months in a 24 Month period. Youre often filing in multiple states and dealing with uncommon concepts like per diems.

A travel nurse explained he was hearing two different stories regarding taxable wages. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. To help you navigate your travel nurse taxes this year we spoke with Joseph Smith tax guru and president of TravelTax.

We can make a lot of money and still do the right thing. In fact he received pay quotes from large companies with. Does this sound right.

Allnurses is a Nursing Career Support site. The difference between travel nurse and staff nurse pay. One story says that an hourly wage of less than 20 for a registered nurse sets off a red flag with the IRS.

Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses. For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income. It provides a lot of question in regards to traveling and taxes.

Take a look at this link. Maintain a mileage Log and keep all your receipts. While I dont get a tax-free stipend the difference in the end isnt a dealbreaker.

Travel Nurse Tax Tip 3. Being a traveling nurse comes with many appealing benefits. My question is would ONLY the income earned in Ca.

In the end I think the majority of nurses without a tax-home will find that travel nursing is indeed worth it even if they only consider the financial aspects. Travel Nurse Tax Tip 2. My effective hourly rate before taxes and with about 10 hours of overtime every week is still in the triple digits.

Allnurses is a Nursing Career Support site. Because this money isnt taxed travel nurses can earn more. This portion of the package is for nurses who prefer to find their own housing through sites like Furnished Finder rather than taking housing provided by their agency.

A majority of travel nurses much prefer to take their housing money and find housing themselves rather than. Our members represent more than 60 professional nursing specialties. It is their job to help the client plan for the future and find ways to reduce their tax burden going forward.

Under the effects of the COVID-19 outbreak the healthcare world is facing unprecedented challenges and the financial landscape is changing quickly. Since 1997 allnurses is trusted by nurses around the globe. As a travel nurse there are a several business deductions you are able to take on your taxes.

The other story says there is no problem with taxable wages between 15-20 per hour. One of the most confusing parts of a travel nurse pay package is the housing stipend. Travel Nurse Tax Tip 1.

Our mission is to Empower Unite and Advance every nurse student and educator. But travel nursing does come with a few financial pitfalls unless youre smart about handling your tax deductions. Are there certain tax publications that would make my tax filing easier.

He can deduct travel costs meals at 50 and lodging. Keep hard copies of all contracts and paperwork. This means travel nurses can no longer deduct travel-related expenses such as food.

Taxes for Travel Nurses. Travel nurse taxes can be especially tricky. Our mission is to Empower Unite and Advance every nurse student and educator.

Travel nurse taxes allnursesAllnurses is a nursing career support site. I live in Florida and receive a retirement pension form the military. Allnurses is a Nursing Career Support site.

Travel nurse pay is different than staff nurse pay because travel nurses are paid with an overall compensation package that includes a base wage and non-taxable stipends for things like housing bonuses and living expenses. Our mission is to Empower Unite and Advance every nurse student and educator. Keep track of your expenses throughout the year to make the most of your deduction opportunities.

Allnurses is a Nursing Career Support site. This puts it in-line or above the national. Since 1997 allnurses is trusted by nurses around the globe.

6y MSN CRNA. The goal of a good tax preparer isnt simply to prepare a historical document which is the real substance of a tax return. State income taxes or would my retirement pe.

Our members represent more than 60 professional nursing specialties. Keep receipts organized into categories such as supplies telephonecomputer uniforms continuing education and travel. Hi there I am considering travel nursing to California but I do not know how the state income tax works there.

Sep 2 2018. Think salesman flying into some city for a couple of days. So I am a first time travel nurse from Ga to another state.

As Tax Season is upon us weve prepared for you answers to the TOP 10 Tax Questions of Travel Nurses. We have one of the most complicated tax systems in the world and navigating the Internal Revenue Code while keeping abreast of congressional tinkering is a daunting task. From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to.

Our members represent more than 60 professional nursing specialties. Since 1997 allnurses is trusted by nurses around the globe.

Travel Nurses Share Your Stories Travel Nursing Nurse Nurse Humor

Nurse Travel Nursing Nurse Midwife

How Does Travel Nursing Work Trusted Nurse Staffing

Report What It S Like To Be A Travel Nurse During A Pandemic

Rates Were Cut For All Travel Nurses This Week By Banner So They All Quit This Week This Shows That Right Decision Was Made Banner Management Is The Worst R Nursing

How Much Do You Really Make As A Travel Nurse Travel Nursing Allnurses

Is This Covid Era Travel Money For Real Sustainable Travel Nursing Allnurses

Travel Rn To New Fnp Is It Worth It Nurse Practitioners Np Allnurses

Travel Nurses Share Your Stories Travel Nursing Allnurses

Ttatn 035 What Is The Annual Salary Of A Travel Nurse Bluepipes Blog

Word Of Warning About Tax Consequences For Travel Nurses Travel Nursing Allnurses

Amazon Com Windham Calling All Nurses Nursing Words

10 Myths About Travel Nursing By Brennen Belliveau Rn Leadhealthstaff

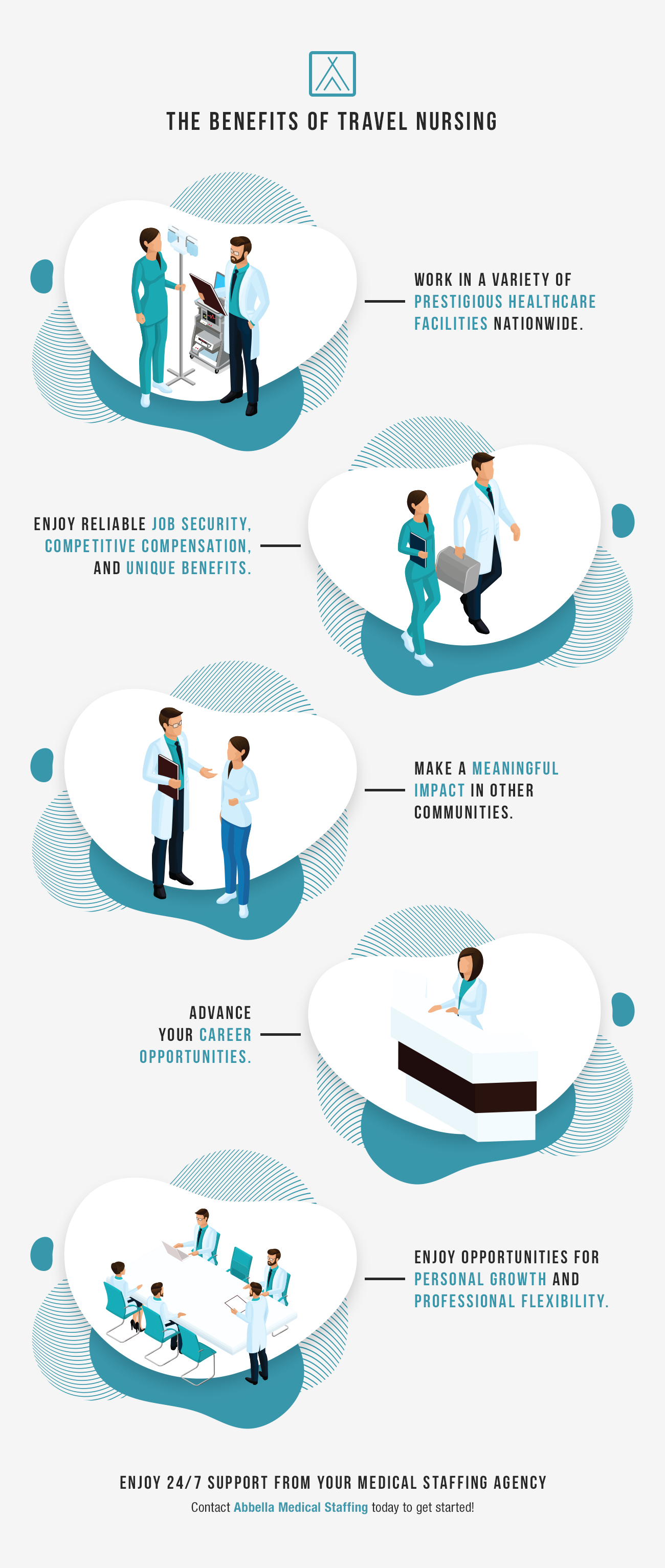

The Benefits Of Travel Nursing Learn More And Apply Abbella Medical Staffing

How To Stop Travel Nurse Bullying Travel Nursing Nurse Healthcare Infographics

Are Nurses Guilty Of Price Gouging For Being Paid 10 000 Per Week In Nyc Which Is Significantly Higher Than Normal American Enterprise Institute Aei

Report What It S Like To Be A Travel Nurse During A Pandemic